Business trips result in travel expenses, such as transportation and accommodation costs. These costs play an important role for employers and employees alike, as they involve both organizational and tax-related aspects. In areas such as field service management (FSM), where field assignments are common, the recording of travel expenses is becoming increasingly important. It is crucial to accurately record the various types of costs and bill them correctly. Precise handling creates transparency and legal certainty in business processes.

What are travel expenses?

Costs incurred as a result of business travel fall under the term travel expenses. These include expenses for transportation, accommodation, and meals, as well as other expenses incurred during a business trip. Legal requirements and tax guidelines determine which expenses are recognized as travel expenses. This ensures that only business-related costs are taken into account and billed correctly.

What types of travel expenses arise during business trips?

Business trips incur various types of costs that must be taken into account when settling accounts. Each category comprises specific expenses that should be recorded separately. This creates a transparent structure that is helpful for both companies and employees. The following points show which types of costs frequently arise during business trips:

What is a travel expense report?

A travel expense report records all expenses incurred during a business trip. It is used to get reimbursed by your employer or to claim the expenses on your taxes. To do this, all important receipts and supporting documents are collected so that each expense is correctly recorded and allocated.

There are clear guidelines on how the statement must be structured:

- A detailed list of reimbursable expenses

- Information on the date, destination, and purpose of the trip

All receipts are submitted and the expenses are clearly organized. This ensures that the travel expense report provides a transparent and comprehensible overview of the costs. Legal regulations and internal guidelines determine how the report must be structured and formatted.

Manage travel expenses easily – with Innosoft FSM

Optimize your business travel expense reports with digital processes and a centralized overview. Innosoft’s field service management solution ensures fast recording, automatic verification, and legally compliant billing of all travel expenses. This minimizes effort and sources of error while significantly increasing cost control. Efficient travel expense management for clear processes and greater planning reliability for field assignments.

Typical reasons for travel in everyday working life

Business trips can generally be divided into internal and external trips. Internal trips take place within the company, for example for training courses, meetings, or location changes. External trips, on the other hand, involve visits to customers, suppliers, or business partners outside the organization.

This distinction is important for planning and accounting purposes, as different cost types and organizational requirements must be taken into account. Clear allocation also makes it easier to comply with internal guidelines and tax regulations.

Flat rates for meals and travel expenses on business trips

Business trips within Germany incur varying meal expenses, which are regulated by fixed flat rates. These flat rates simplify accounting, as individual receipts do not have to be submitted. The mileage allowance for the use of private cars is also particularly relevant and is taken into account when reimbursing travel expenses. In addition to travel and meal allowances, incidental travel expenses such as parking fees or tolls can also be reimbursed, provided they are documented.

Flat rates for travel within Germany

For business trips within Germany, clear flat rates apply for the reimbursement of meal and travel expenses. These flat rates simplify the process, as individual receipts do not need to be submitted.

These flat rates enable simple and transparent billing without having to submit individual receipts.

Field service management and the role of travel expenses

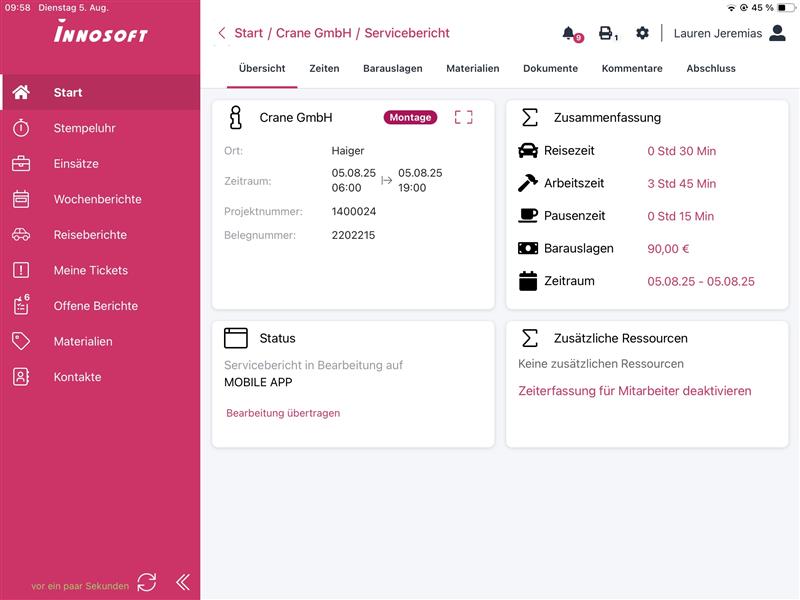

An FSM solution such as Innosoft simplifies the organization and billing of expenses incurred during field assignments. The use of digital tools makes processes faster and more transparent. At the same time, the technology helps to comply with legal and internal company requirements.

The advantages of FSM for travel expense management are particularly evident in the following areas:

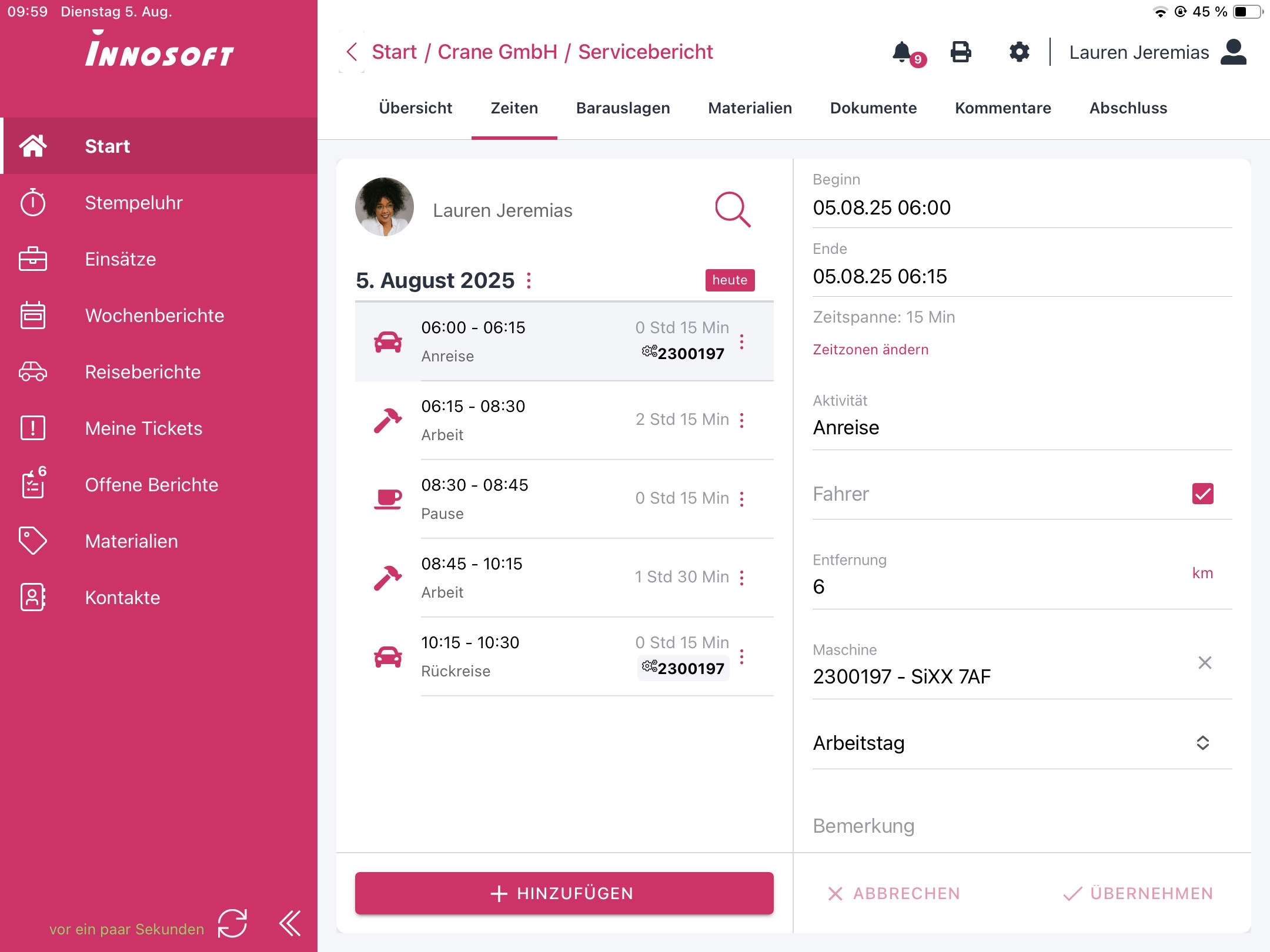

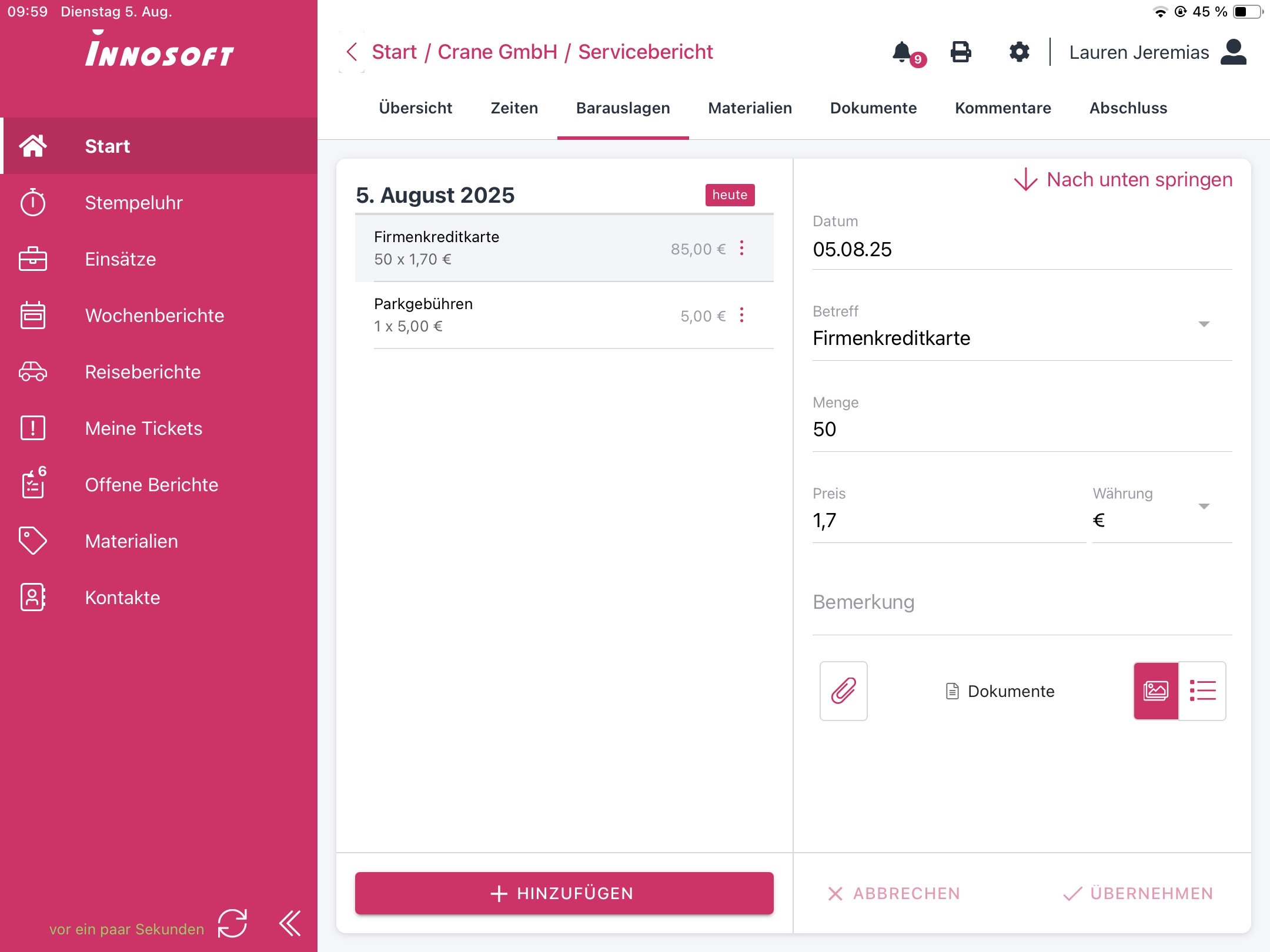

Receipts and expenses can be recorded and uploaded directly on site using mobile devices. This eliminates the risk of loss or incomplete documentation. Digital recording also speeds up the processing and settlement of travel expenses.

Automated processes take care of compiling and checking costs. This minimizes manual errors and significantly reduces processing times. At the same time, it takes the pressure off those responsible in the office and frees up capacity for other tasks.

The software ensures that only reimbursable costs are taken into account and that all necessary supporting documents are available. In addition, legal regulations and internal guidelines are automatically taken into account. This supports legally compliant and transparent billing.

The central recording of all travel expenses allows cost items to be accurately recorded and analyzed. This provides a precise overview of the actual cost rates, enabling targeted control of expenses. The clear presentation of cost rates helps to identify potential savings and improve the cost-effectiveness of field assignments in the long term.

Tax aspects of travel expense accounting

Expenses incurred during business trips are subject to clear tax regulations. Reimbursements for travel, meals, and accommodation costs can be granted tax-free by the employer and claimed by the employee for tax purposes. Travel expenses can be deducted if the trip is for business purposes and the expenses can be proven. In addition to employees, self-employed persons and certain freelancers can also claim these costs for tax purposes. Different flat rates and documentation requirements apply depending on whether the trip takes place domestically or abroad. Precise documentation and correct accounting are prerequisites for taking advantage of tax benefits and avoiding conflicts with tax authorities.

Efficient travel expense management with Innosoft FSM

Keep track of all expenses, capture receipts digitally, and make billing transparent and traceable. Innosoft’s field service management solution simplifies travel expense management and helps you comply with legal requirements – for optimized cost control, less administrative work, and clear transparency for field assignments.

Travel expenses under control: efficient management with Innosoft FSM

Transparent and error-free travel expense reporting starts with digital recording of all expenses and receipts. Innosoft’s Field Service Management solution helps you record travel expenses in a structured manner, bill them correctly, and ensure compliance with legal requirements.

The central recording and management of travel, meal, and accommodation costs creates complete documentation that facilitates both internal processes and external audits. Automated processes reduce administrative effort and ensure fast, transparent cost control.

Employers benefit from clear evaluations, well-founded decisions, and better control of travel expenses in the field. This allows budgets to be optimally adhered to and the cost-effectiveness of business trips to be improved in the long term.

Would you like to find out how Innosoft can make your travel expense management more efficient? We would be happy to show you how digital solutions can simplify your cost management.

Frequently asked questions about travel expenses

Travel expenses are usually covered by the employer. The employer will reimburse expenses incurred for business trips, provided they are properly documented and accounted for.

Contact us for more information about our FSM software!